DENVER — On Nov. 7, Colorado voters will decide the fate of Proposition HH, a complicated and important state ballot measure that could impact every citizen, regardless of the outcome.

Democrats in the Colorado General Assembly, along with Gov. Jared Polis, are pushing Proposition HH, which they say will provide immediate relief for property owners facing huge property tax increases.

“This is really an urgent moment when it comes to property tax in the state of Colorado,” said State Senator Chris Hansen, D-Denver. “[Proposition] HH is really designed to blunt this big spike in property taxes.”

Hansen said Proposition HH has a lot of moving parts.

As far as ballot measures go, it’s certainly one of the most complicated Colorado has seen. And to be clear, property taxes would still go up if the measure passes, just not as much.

Politics

Colorado voter guide 2023: A look at the key issues on the November ballot

“Most Colorado families are seeing 40, 50% changes in their property values. This would knock that roughly in half,” said Hansen, a member of the Colorado Senate Appropriations Committee and one of the most visible supporters of Proposition HH.

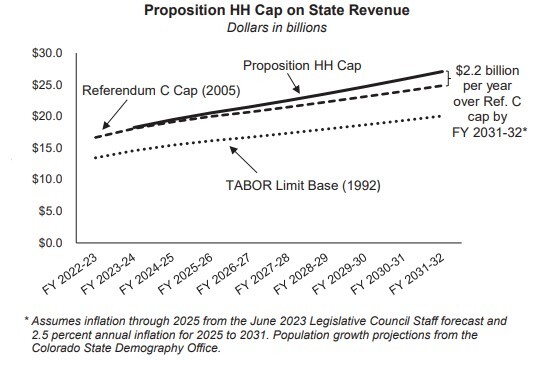

In exchange for property tax relief, Proposition HH would allow the state to keep some of the money that would otherwise go back to taxpayers in the form of TABOR refunds. Instead, the state would use this surplus money to “backfill” or replace funding for counties, fire, ambulance, hospital, and school districts that depend on property taxes.

“It provides direct property tax relief in this moment, but it does it in a way that doesn't hurt local services and particularly doesn't hurt schools,” said Hansen.

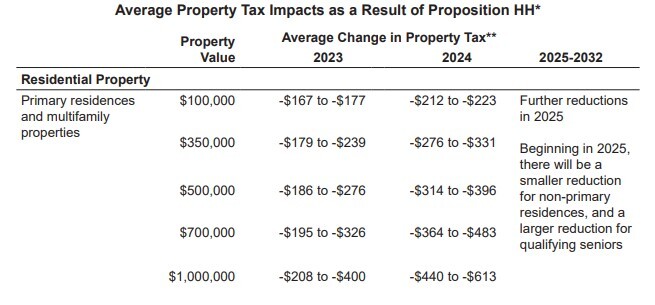

Nonpartisan analysts with the Legislative Council of the Colorado General Assembly said if Proposition HH passes, a homeowner with a home valued at $500,000 would see their property tax increase decline anywhere from $186 to $276 dollars for this tax year. That would be followed by another reduction in the increase in 2024.

As for TABOR refunds, those same nonpartisan analysts say every Colorado taxpayer, regardless of income, would get an equal amount next year. Right now, that’s estimated to be $898.

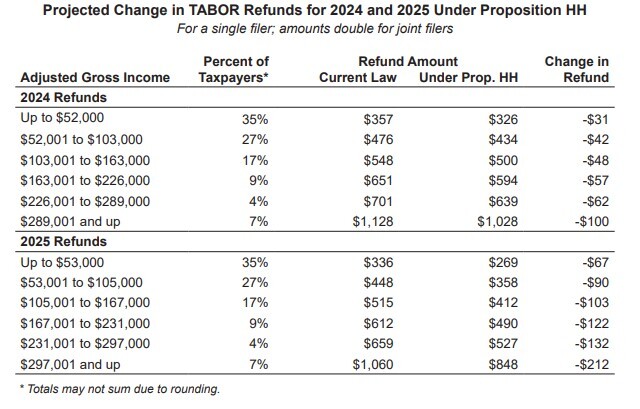

Lower-income earners, many of whom are renters, would see the biggest increase in TABOR refunds. However, higher earners, starting with those making over $99,000, will see a decrease in their TABOR refunds.

Legislative Council analysts say everyone will see a decrease in TABOR refunds in 2024 and 2025.

Opponents of Proposition HH say the governor and Democrats are trying to pull a fast one on Coloradans.

“This is about taking money and growing government,” said Michael Fields, president of Advance Colorado.

“They wanted to take this opportunity to not really lower property taxes. They wanted to take the opportunity to go after our TABOR tax refunds,” Fields continued. “They're not being honest at all. They know that voters aren't stupid, that they understand what's going on. They’re learning more about it.”

Scott Wasserman, the president of The Bell Policy Center, a left-of-center think tank, said opponents of Proposition HH are being “irresponsible” and “reckless” with some of their arguments against it, especially when they claim TABOR will be eliminated.

“The only time that the TABOR surplus goes away is if the economy drops and surpluses go down. The surplus is completely a function of our economic activity. So I think it's really dishonest, particularly the way they're saying it,” said Wasserman.

Because every Coloradan’s financial situation is different, the Legislative Council created a Proposition HH calculation website where people can enter information to see how the measure will impact them if it passes. They also sent a blue book to the home of every voter, containing detailed information on Proposition HH across 14 pages.